SBS Insurance Services has completed its first deployment of UnlikelyAI’s low-risk enterprise AI in a regulated environment, following several years of development by UnlikelyAI. The pilot automated 40% of claims-handling tasks, achieved 99% accuracy, and generated a complete audit trail for 100% of decisions—supporting faster customer outcomes while meeting strict governance requirements.

Tackling the key barriers to AI in regulated insurance

Insurance firms operate under high standards for consistency, transparency, and explainability. While large language models (LLMs) can appear efficient, their use in regulated decision-making is often constrained by three recurring issues:

Hallucinations: Even advanced LLMs can produce incorrect or misleading answers; OpenAI has reported error rates of up to 37% on factual questions in its own analysis. In claims, this typically increases the need for human oversight and slows resolution.

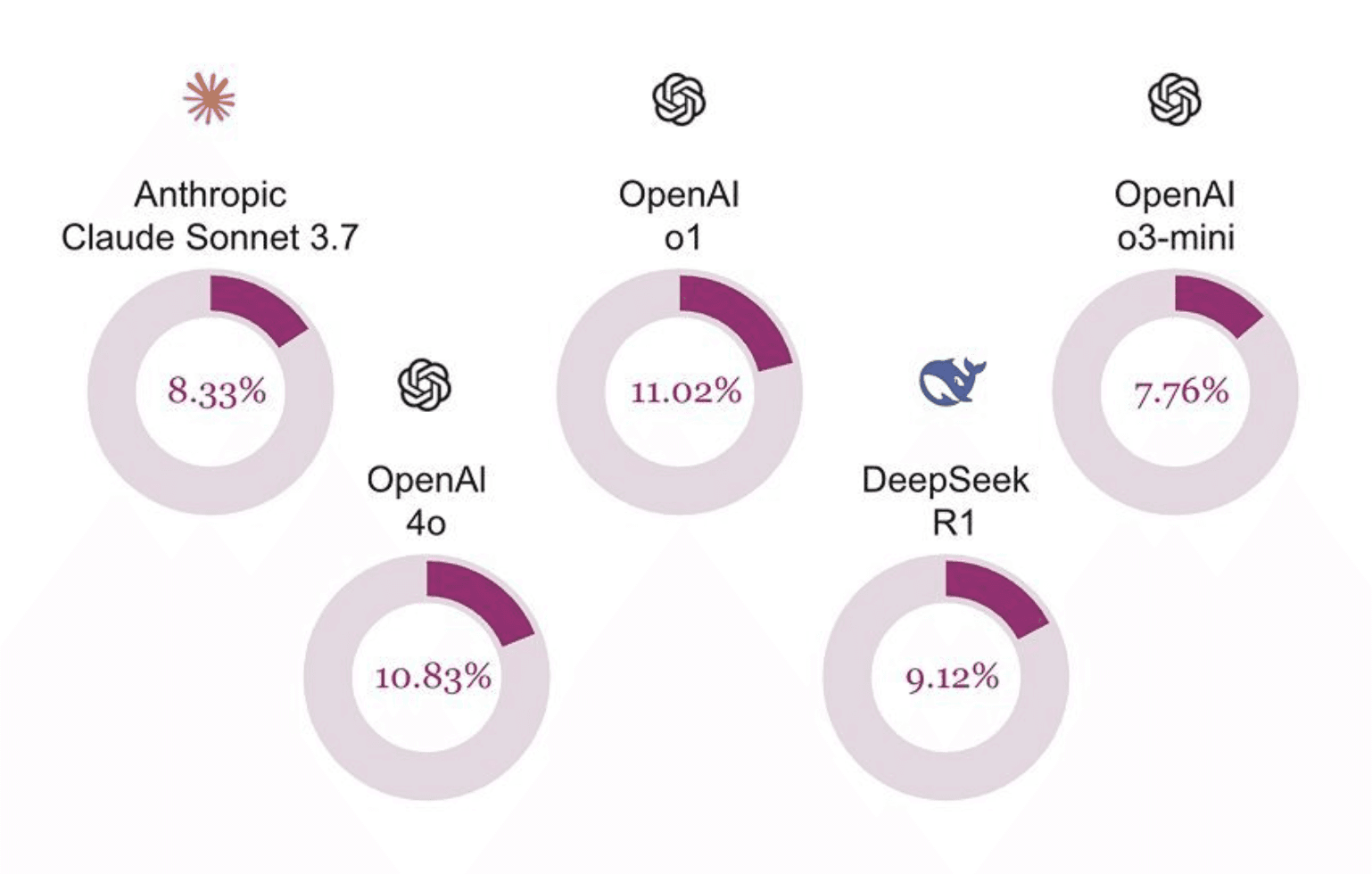

Inconsistent outcomes: LLMs can return different answers for the same input. UnlikelyAI’s internal testing found that models such as Deepseek R1 and Meta’s Llama assessed identical claims as “covered” anywhere from 8% to 46% of the time, and that repeat runs could produce different results roughly one in ten times.

Limited auditability: Regulators require explainable decisions, yet LLMs can be difficult to interpret and may provide incomplete or inaccurate rationales.

Why SBS selected UnlikelyAI

SBS chose UnlikelyAI because its approach combines neural networks with symbolic reasoning—a rule-based, transparent method that supports consistent outcomes and clear explanations. This enables SBS to demonstrate how decisions are reached, providing clarity for customers and confidence for regulators.

UnlikelyAI’s software also complements SBS’s existing claims expertise, deferring to human judgement where appropriate. In the pilot, SBS recorded 99% accuracy (compared to ~52% for LLMs), automated 40% of test claims, and reduced mis-categorisation by 99%, enabling faster and more consistent service while preserving a human touch where it matters.

Quotes

William Tunstall-Pedoe, Founder and CEO of UnlikelyAI, said:

“We built UnlikelyAI to address the fundamental limitations of large language models, especially in high-stakes industries where trust, precision and transparency are essential. This deployment—our first to be made public—demonstrates that AI doesn’t have to be a black box; it can be transparent, explainable and genuinely accountable. Our approach enables regulated businesses to confidently adopt AI without compromising on compliance, consistency or customer trust.”

Bazil Crowley, Director of Innovation at SBS Insurance Services, added:

“We’ve always prioritised excellent customer service and using technology as an enabler. UnlikelyAI’s neurosymbolic approach stood out as a step change for our operations, allowing us to deliver a faster, more reliable service to customers while maintaining our human touch where it matters most. We’re excited to help set a new standard for intelligent, explainable claims processing.”